Revisiting the Relationship Between Income and Democracy Using Panel Econometrics

Project Overview:

This project replicates and extends the seminal work of Acemoglu, Johnson, Robinson, and Yared (2008) on the relationship between per capita income and democracy. Using advanced panel data econometric techniques, we investigate whether there exists a causal relationship between economic development and democratization.

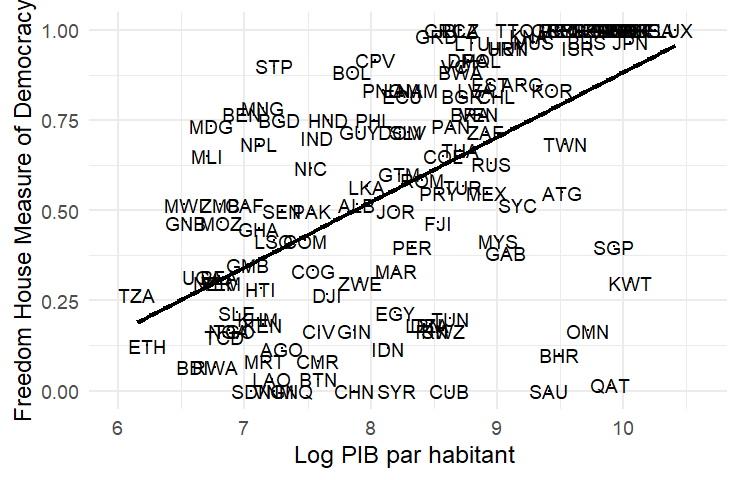

Key Question: Does income cause democracy, or is the positive correlation driven by omitted historical and institutional factors?

Research Objectives

- Replicate the findings of Acemoglu et al. (2008) using panel data methods

- Investigate the causal relationship between income and democracy

- Apply advanced econometric techniques: Pooled OLS, Fixed Effects (Within Estimator), Anderson-Hsiao IV Estimator, Generalized Method of Moments (GMM)

- Test model validity using Arellano-Bond autocorrelation test and Hansen-Sargan test for overidentifying restrictions

Data Description

Dataset Characteristics:

- Time Period: 1950-2000 (5-year intervals)

- Countries: 211 countries

- Observations: 11 time periods per country

- Total Observations: 2,321

Variables:

- democracy: Freedom House Political Rights Index (normalized 0-1)

- income: Log GDP per capita (Maddison Tables 2003 + PPP estimates)

- country: Country identifier

- year: Time period (5-year intervals)

Methodology

The dynamic panel data model is specified as:

d_it = α·d_i,t-1 + γ·y_i,t-1 + X'_i,t-1·β + μ_t + δ_i + u_it

Where d_it is democracy level in country i at time t, d_i,t-1 is lagged democracy (captures persistence), y_i,t-1 is lagged log income per capita (main variable of interest), X_i,t-1 is a vector of control variables, μ_t are time fixed effects, δ_i are country fixed effects, and u_it is the error term.

Estimation Strategies

- Pooled OLS: Simple benchmark estimation with positive bias due to correlation between lagged dependent variable and error term

- Fixed Effects (Within Estimator): Controls for time-invariant country characteristics, shows negative bias (Nickell bias)

- Anderson-Hsiao IV Estimator: Uses first differences to eliminate fixed effects, instruments with 2-period lagged levels

- GMM (Arellano-Bond): Most efficient estimator under no serial correlation, uses all available moment conditions

Key Results

Main Findings

- Cross-Sectional Analysis: Strong positive correlation between income and democracy

- Panel Data with Fixed Effects: ⚠️ The relationship disappears! Once country-specific factors are controlled, income has NO significant effect on democracy

- Dynamic Persistence: Democracy shows strong persistence (α ≈ 0.38 to 0.71)

- Causal Interpretation: No evidence of causal effect of income on democracy. Positive correlation likely due to omitted historical and institutional factors

Statistical Tests

| Test | Statistic | p-value | Interpretation |

|---|---|---|---|

| AR(2) - Arellano-Bond | 0.8437 | 0.3988 | No second-order autocorrelation ✓ |

| Hansen J-test | χ² = 70.745 (df=44) | 0.0064 | Overidentification restrictions valid |

Technical Implementation

R Packages Used:

plm: Panel data econometricslmtest: Diagnostic testssandwich: Robust standard errorsstargazer: Table formattingggplot2: Visualizationsdplyr: Data manipulation

Academic Context

This project was completed as part of the Panel Data Econometrics course at INSEA (Institut National de la Statistique et de l’Économie Appliquée) in Rabat, Morocco, under the supervision of Ilyes BOUMAHDI.